Empowering Real Estate Developers to build "The Missing Middle"

The "Missing Middle" of real estate developers New real estate developments are increasingly created by one of two types of developers - either large enterprise companies or small local builders.

Background Reading: This article builds on our exploration of why real estate has been slow to adopt technology, how AI data ingestion creates opportunities for better real estate tools, and how AI helps real estate teams unlock their internal data.

At the top end, large projects are typically developed by enterprise scale, corporate players. In 2023, the top 25 developers accounted for 20% of all multifamily starts in the United States. For single family homes, the top 10 builders accounted for 28% of all completions. These are large companies that heavily benefit from economies of scale. They have centralized service functions such as accounting and legal, they have in house subject matter experts and the volume of their projects make them an appealing offer to institutional investors. They face challenges like any big company does - corporate bloat, slow decision-making, and talent retention.

At the other end, there is a long tail of local builders and developers that do small scale projects. These builders are successful because of their local market connections, their self-reliance, and their individual focus. The projects they do are typically quick to build and self-financed. The successful builders are great at executing projects, but oftentimes struggle with the administrative overhead. Their limited process documentation and lack of financial controls make it difficult to scale up their operations and limit their ability to raise capital from banks or other institutional capital providers, and these firms often operate with razor thin margins.

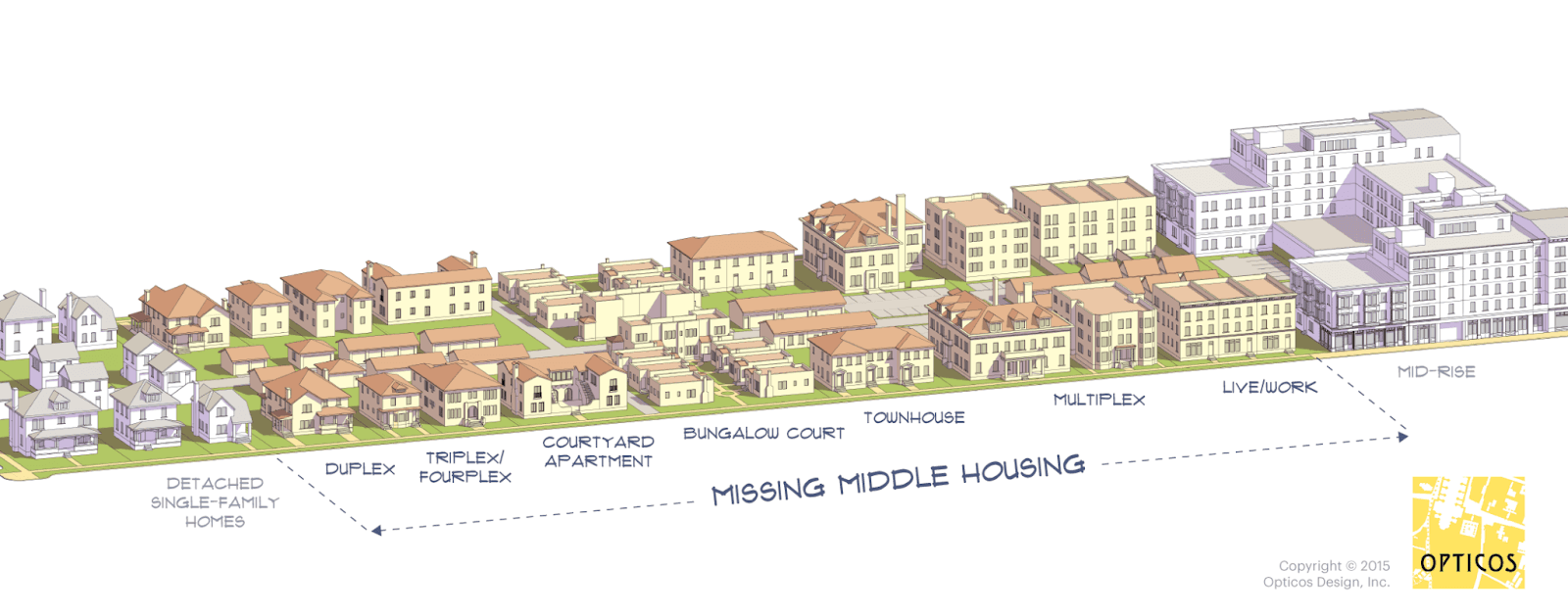

There are small players doing small projects, and there are large players doing large projects. In the middle there is a gap. This "missing middle" is well documented and often described in near utopian terms by urbanists and city planners as the solution to better cities and more affordable housing. Much of the advocacy work of YIMBY groups has been focused on reforming zoning and building codes to allow for more types of housing and building.

The challenge of the "Missing Middle"

Fixing laws and zoning is a necessary first step. The next step will be empowering real estate developers to actually build those projects. The reality of the matter is that real estate development is hard, even if zoning and permitting can be expedited.

Developers trying to build the missing middle risk getting caught in no man's land. Their projects are too big to operate without administrative and operational support, but they are too small to justify the cost of that support. Developers, who should be spending their time elsewhere, end up devoting significant time and frustration to retrieving information, completing paperwork, managing documents, and pushing numbers. Coby Lefko wrote a fantastic article about the challenges faced by small developers that's linked here.

Large Language Models (LLMs) are a recent technological unlock that offer a path forward. It remains to be seen if artificial intelligence will live up to its full hype, but there is no arguing with its ability to process information in a human-like manner and make sense of unstructured data.

Operational and Administrative Challenges faced by Real Estate Developers

Legal Structures and Entities

Real estate development projects are oftentimes created using multi-member special purpose entities (SPEs). These SPEs each have their own formation documents, bylaws and operating agreements.

In their simplest form, investors will join a development project by making a direct investment into a special purpose entity. The SPE will engage directly with consultants for professional services, a general contractor for construction, and banks for construction financing. Oftentimes, the developer will manage the project via a development services agreement between the SPE and the developers management company.

The flow of funds between investors, lenders, and these entities can be quite complex. Investment terms, fees and promote structures also may vary, which adds complexity. Developers must be careful to keep accurate records to ensure outside capital is managed responsibly.

Underwriting and Pro Forma

For every project, Real Estate developers must create and maintain a Pro Forma. The Pro Forma is a financial model that reflects the projected returns and value of a development project. Typically these are created in Excel or Google Sheets. They vary in complexity, but the best models will show projected returns, detailed cash flows, cost breakdowns, and timeline. Returns expressed in terms of IRR and MOIC are usually the key outputs, and a detailed breakdown of sources and uses of capital is usually required by lending and investing partners.

Creating the Pro Forma and validating the assumptions is a process referred to as underwriting. Before a developer moves forward with a deal, they want to be sure that the profits are going to be worth the time, effort, and capital they invest into the deal. Developers will oftentimes have IRR and MOIC targets that they will be checking their proforma against. To underwrite, they will validate key assumptions like rent rolls, sale price, construction costs, financing costs, and so on.

Once the initial Pro Forma has been created and underwritten, there is ongoing work required to keep assumptions updated and ensure the project stays on track financially.

Plans, Specs, and Permits

A key piece of any real estate development project is the plan set. Plans are usually created with the help of an architect, and they describe the specifications of what is going to be built.

In most jurisdictions, some form of building approval or permit is needed to begin construction. The process for getting that approval varies, but almost always involves submitting plans for review and approval. Developers need to consider a variety of zoning laws and safety codes when drafting plans. After submission, developers may need to respond to plan check comments with updates to their plan set or clarifications on building codes.

Simultaneously, developers must work with their architect and general contractor to create the construction plan set. This will match the plans submitted for zoning approval, but will have additional detail that the general contractor will use to bid out the project. The construction plan set will also specify materials and items selected by the developer and designers.

Contracts, Invoices, Tax and Accounting

Developers are responsible for implementing financial controls and maintaining accurate accounting records. In order to deliver strong returns, developers must carefully manage their expenses to meet or exceed their underwriting targets.

Developers will seek to "buy out" their projects as quickly as possible by signing contracts with vendors to lock in a price. When these vendors submit invoices, developers must be careful to ensure that the invoice matches the work from the contract and that the work being invoiced has been completed.

All of these payments must be accounted for accurately and diligently. Up to date accounting records are important for financial management, tax purposes, and diligence requests from investors and banks.

Investment and Loan Documents

Developers will often partner with outside investors or lenders to finance their projects. Most deals are capitalized individually, and each deal can employ different forms of financing. The most common forms are equity, preferred equity, mezzanine debt and construction loans. However, depending on the type of project and the specific investors, developers may employ more creative financing vehicles.

Because investment terms can vary so widely, developers and investors both must pay careful attention to the "return waterfall." The return waterfall specifies the order in which proceeds from a project are paid out. Safer investments with lower returns are paid out first, while riskier investments with more upside are paid out last. Developers often incorporate "Promote" structures into the waterfall, where they will earn a larger share of the profits for projects that generate higher than benchmark returns.

Construction Draw Requests

Developers will oftentimes partner with banks for construction loans. Banks do not give the capital to developers upfront - instead, every 3-5 weeks developers will collect all their invoices and the pay applications and submit this to the bank as a draw request package. This draw request package is usually sent as a PDF and can be anywhere from 25 to 500 pages in length.

The draw request package shows the bank how funds are being used and how the project is progressing. The package includes an up to date budget, a progress report, consultant invoices and the Pay Application from the general contractor. The pay application should have all of the invoice backups from the subcontractors, and importantly must also have their lien release waivers and insurance certifications. Developers need to carefully review these pay applications to ensure everything is properly documented and that the pay requested matches the work that has actually been completed. The bank will order an inspection to verify that information in the draw request is accurate before advancing funds.

How AI powered tools can solve these challenges

One of the most difficult parts of real estate development is managing the complexity of projects and maintaining accurate records. Each project is specific and unique, and good developers must fully understand and embrace the details and nuance to generate profits. The key to consistently executing successful development projects is mastery of the details.

Historically, real estate developers have had limited ability to use software to help manage this complexity. Computers have not been good at understanding the ambiguity that is present in real estate development. Instead, if real estate developers want to use software they must first go through the arduous process of manually entering their data. Even then, traditional software tools struggle because of the inherent limits of expressing complex details in neat rows and tables.

AI powered tools offer an alternative for Real Estate developers seeking to better manage complex projects and efficiently scale up their operations. Large language models are already very good at reading documents and extracting key information, which eliminates the need for developers to do data entry. AI models are able to ingest complicated terms and process them the same way humans would. Similarly, computer vision models are rapidly advancing to the point where computers can understand the context gained from a jobsite photo.

These are exciting advances in technology that are going to have real life benefits for real estate developers. Developers will now be armed with computational power that can process the context of their development projects. They won't need to spend time looking up investment terms or manually reviewing pay applications because their AI based tools will be doing that for them. Developers can focus their time where it's most valuable, and can trust that invoices are being properly coded, contracts carefully reviewed, and investments safely managed.

Right now, development is largely being done by small, local players or large, enterprise corporations. AI based tools for real estate development offer a path forward for the "missing middle." Small developers can scale up and leverage AI tools to manage the operational and administrative burden. Individuals at large enterprises can start their own firms and projects without needing to rely on centralized corporate services.

At Deco Base, we're building AI powered tools to make this possible. Please reach out to us if you are interested in learning more.

Explore More: Learn about how AI simplifies real estate development analysis and discover the philosophical implications of AI in real estate.